July 1, 2017 India got the crucial tax reform till date- ‘GST’. Till date what we know about this new regime is this is an additional payable amount which we suppose to count with the shopping bills. Goods and Service Tax is a single playable tax which dismisses 11 indirect individual taxes including VAT. The current market is not so aware of the entire GST pragmatism; the trap is already set to string along your purchase just by showing a dupe GST bill.

In real estate business, on-hand projects catch 12% and ongoing project investment 18% GST taxation. Under the GST goods and service providers will get benefit of input tax credit for the purchased raw materials used for the project development. Stamp duty and property tax will be subsumed. GST council composed of the state ministers and headed by Union Finance Minister Arun Jaitley has announced to introduce and give effect to National Anti-Profiteering Authority, set up under GST law.

Buying home is one of the major decisions of lifetime, forget the real estate for the time being, when you are purchasing something from the malls, do you really crosscheck the billing amount or are you sure the GST rate is collected from you is the right one? The fact that we all should know is that businesses that have not registered their business under GST, are not eligible to collect the GST tax. The reason behind such activity might be for their less turn over or escaping from this new tax regime. But who knows these businessmen are generating GST bill and smoothly collecting money from the end-users against their purchase.

How to verify GST bill and GST number?

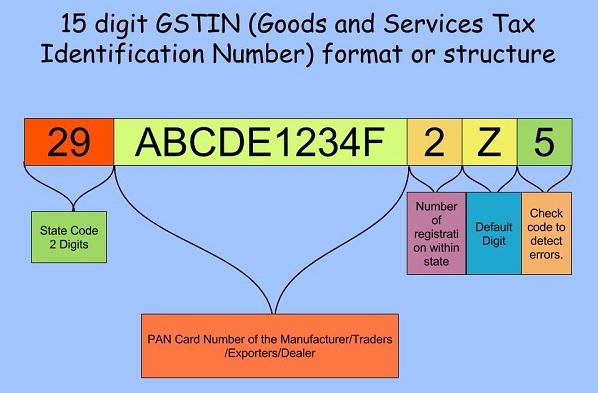

One can verify any fake GST bill or GST number easily. Let’s look at the basics about GST number or GSTIN. In a bill you usually find a term called ‘TIN’ which confirms the ‘Tax Identification Number’. This ‘TIN’ is now ‘GSTIN’ carrying 15 digit number after GST implementation. It’s just the replacement of TIN of the VAT era. GSTIN is a 15 digit unique code for individual taxpayer, which will be both state wise and central-based. The first couple of digits of the GSTIN represent the state code according to Indian Census 2011. After that the ten alpha-numerical code is the PAN card number of the manufacturer/dealer/trader or the exporter. Coming to the 13th digit of GSTIN it indicates registration as a business entity within a state against the same PAN number. The 14th slot will be by default as Z.The last digit is a check code which will be used for recognition of errors.

For crosschecking GST rates on the commodity you purchased visit-

https://cbec-gst.gov.in/gst-goods-services-rates.html.

To verify the genuineness of GSTIN visit-

https://services.gst.gov.in/services/searchtp

To complain against any fraudulence transaction mail at

helpdesk@gst.gov.in

Or call- 0120-4888999, 011-23370115

_ LNN (Liyans News Network) – To Sell/Rent your property in Kolkata we offer free property listing service. Upload your property images and fill up a simple form under post your property in Kolkata category.